Market Insight Editorial & Advice to Tenants: 3Q2009

In this Issue:

- Editorial from Dan Mihalovich, Principal of Mihalovich Partners and Founder of The Space Place®

- San Francisco Market Overview

- Take Me Straight to the Numbers: San Francisco Bay Area Rental Rates. Supply/ Demand.

- Who Has the Most Space in San Francisco? Surprise…

Underdogs Rock: Our Trip to U.S. Open Tennis

U.S. Open 2009

U.S. Open 2009Our trip to the Mecca of tennis over Labor Day weekend was a combo visit to see the most spectacular array of the world’s greatest tennis, of course, but also to see my close childhood friend, John McConnell. Many of you will remember John as the former #2 at KGO Radio and subsequently head of programming for ABC Radio’s network. The U.S. Open is media-Mecca as well, but our focus over the weekend was tennis in the morning, noon and at night…with a healthy break to take my daughter around NYU and surrounds to scope out the “campus”.

Our host, San Francisco native and former Pepperdine tennis-great, John McConnell with yours truly and my daughter Cayla

Our host, San Francisco native and former Pepperdine tennis-great, John McConnell with yours truly and my daughter CaylaThe television-version of the U.S. Open misses a lot of the action, actually. We followed Cal Coach Peter Wright (and numerous coaches from around the world) as they gathered just outside the main venue to watch the U.S. Open Junior Championship, all scouting the action and developing relationships with the youngsters we’ll all come to watch shortly. These players will ultimately compete in the Futures and Challenger circuits to gain those coveted “points” to allow them to qualify for the major tournaments. It’s an incredibly competitive field.

Kim Clijsters (aka “Mom”), 2009 U.S. Open Champion!

Kim Clijsters (aka “Mom”), 2009 U.S. Open Champion!It’s always a treat to hang out at the Open with another old friend, Tom Ross, sports-agent-extraordinaire, whose company represents around 1/3 of the players on the tour. We were rooting for his client, American-great, Robby Ginepri, as he makes his way back to form after a life-threatening episode with appendicitis.

So much credit and congrats to the totally gutsy play of Kim Clijsters and Juan Martin Del Potro, both Open Champions. There’s always room for the underdog to shine—and an opportunity to shake up a complacent crowd who’s usually expecting the same old victors in the winner’s circle. I take that message to heart.

Hosting the Serbs: Tiburon ATP Challenger Finalists

The ATP Challenger Tour came to our little town in Marin, and we were fortunate to host two of the tournaments greatest talents for nine days: Ilija Bozoljac (current member of the Serbian Davis Cup Team, alongside Novak Djokovic) and Dusan Vemic (9-year Davis Cup veteran). Both have victories over several of the world’s top players. Coincidentally, both advanced to the Tiburon finals; Ilija lost a tough 3-setter in the singles and then teamed with Dusan just an hour later to play a tight doubles final. The discipline of champions is intriguing to watch, up close, daily. “Clean” food, lots of water and rest, no alcohol, strategy discussions, plenty of time in the gym before practice….and repeat. Both men serve in the 140s m.p.h.

One of the week’s highlights? Getting a serving lesson from Vemic. Did I break 100 m.p.h.? I think so, but only we were there to see it.

Within an hour of their farewells to the crowd in Tiburon, both were packed and in a car to Los Angeles en route to the next ATP Challenger event. Perhaps this life seems sexy to you, but up close it’s an awful lot of hard work, 35 weeks per year away from home and family and as challenging a pay-day as ever.

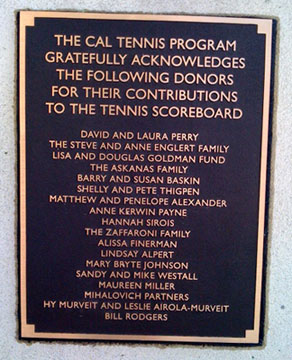

Helping Cal Roar: Mihalovich Partners Capital Campaign

This is a much larger story than we can cover in this writing. The UC system, like scores of California entities under financial pressure, needs our support more than ever before. I chose to send 10% of our 2008 gross to the Tennis program at Cal. I wanted to inspire corporate giving…no matter which educational institution you admire. In the words of Nike, “Just Do It”.

If Your Lease Will Expire Within the Next Three Years…

or if there is another compelling reason to discuss your firm’s office leasing situation, please call us. Dan Mihalovich, 27-year tenant-representation veteran, will respond to your inquiry.

To our clients and prospective clients (all tenants), this is an unprecedented time in history to be starting a facilities-related Blue-Sky Strategic Review. The office markets have never been this ripe…and they’ll remain malleable long enough for you to complete a timely and thorough analysis of your long term needs and aspirations for your company.

For qualified tenants, we offer the following pre-contract services:

- Free preliminary office lease and operating expense review;

- Free consultation to discuss project management, Team formation and project schedule;

- Market surveys and our specific tenant-driven leasing recommendations; a copy of your landlord’s portfolio analysis and

- Assistance in selection and coordination of all Team members throughout planning and negotiation phases; and a discussion about the value of “Team”.

As I mentioned in last quarter’s market commentary (“Perspective is Paramount in Negotiations”), rental rates are cheaper today than 27 years ago, when I began representing tenants in leasing negotiations…not adjusted for inflation. Market growth in Q3 was less than zero in all Bay Area counties. The City now offers more than 20 million square feet of space available. Relatively speaking, this vacancy is exponentially worse than the oversupply of residential housing on the market. Tenants: This is your kind (and our kind) of market! You should expect heavily tenant-oriented market conditions for at least the next five years.

Bottom Line: A quick look at our table of data shows that tenants needing between 5,000-10,000 square feet have 73% more options now than during the Dot-Bomb period. Tenants seeking 10,000-20,000 square feet have 31% more options; and those seeking 20,000-40,000 square feet have 49% more options than during the Dot-Bomb period.Guarding the Henhouse: Absurd Conflicts of Interest

We’ve run out of adjectives to describe the deceit and malfeasance which led to the Great Recession. But it’s not been difficult to identify the culprits. The Wall Street Lobby (as I’ve said for years, the most powerful lobby on the planet); the unregulated CDS market; banks; hedge funds; insurance companies; complacent and compliant politicians; speculative consumers; our Regulators; the credit agencies; all, and more, had a hand. The economy’s undoing was accomplished right under our noses—within clear view of absurd conflicts of interest.

The more difficult task is preserving the memory of those failures and misguided “advice” long enough to learn from our mistakes. Patriotically, that is just not American. “Man up” and move on….that’s more like it.

Similarly, don’t miss the message: It’s painfully obvious which commercial real estate firms guard the “henhouse”—those who protect and advance the interests of the largest landlords in the country. Unwatched and without regulation, look what transpired on Main Street. And yet, commercial real estate tenants, you allow these firms to represent you:

CBRE

Cushman & Wakefield

Colliers

JLL

Newmark, Cornish & Carey

These brokage firms control over 60% of all listings and are beholden to 400 local landlords, paid to drive up rental rates and drive down concessions for tenants.

Can your firm be objectively advised and aggressively represented by one of these landlord-driven companies? If these firms are currently or prospectively aligned with the landlord community, what is your risk in leaving money on the table during negotiations? What duties of disclosure do you expect from these brokers and do they literally make the proper disclosures besides “Trust me.”?

Gretchen Morgensen, New York Times columnist, wrote “…our regulators refuse to produce complete documentation and accounts of the actions they took during the crisis. And keeping taxpayers in the dark isn’t exemplary behavior.” What is exemplary about commercial real estate brokers who do not accurately disclose their conflicts of interest? And tenants, if you don’t mind, is it alright to simultaneously represent your competitors or the interests of others whose needs will potentially trump yours?

Morgensen continued:

Even though calamitous lending practices laid waste to the nation’s economy, surprisingly little has changed about how the financial arena operates and is supervised. Sure, a couple of venerable brokerage firms have vanished, but many of the same players remain on the scene, in the same positions of power.

Senior regulators who stood idly by for years as financial firms built their houses of cards have been rewarded with even bigger jobs or are jockeying for increased responsibilities. The Federal Reserve Board, for example, wants to become the financial system’s uber-regulator, even though its officials did nothing as banks made deadly decisions to lend recklessly and leverage themselves to the max.

Who’s watching the henhouse? Think about it.

Office Space Derivatives!

Some of you believe that commercial real estate has become far too leveraged and over-bought during the past several years. Some (yours truly) postulated that investors chased values into pricing territory known only to those under the influence of Kool-Aid (Tom Wolfe’s variety), pushing $600-$700 per square foot in San Francisco….values that had no basis relative to actual office leases in place or to come. But perhaps the market hasn’t had its fill of rabid speculation. After all, in the midst of our darkest days since the Great Depression, buyers are starting to line up once again. Let’s give them something to cheer about:

Office Space Derivatives.

Office space derivatives could trade in much the same manner as trillions of dollars in credit default swaps have to this point in time: In the backrooms, in the dark, in the weeds. No one would ever find out that the 20 million square feet of available space on the San Francisco market—the “underlying asset” for the derivatives—could have hundreds of millions or even billions (!) of dollars worth of open derivatives trades supporting the supply. If big players like Blackstone or Hines or Boston Properties wanted to “hedge” their bets, they could offset their risks on vacant space by trading space derivatives.

Even office leasing brokers could get into the game. If you believe that a tenant over-paid for their space, why not “short” the building’s space?! Which leads one to another supposition:

Office Tenant Derivatives.

Well, are tenants not the “underlying asset” for an office building? If the tenant isn’t a public company (in which case we could simply short their stock), why not “short” the tenant through a derivatives trade?!

This could truly be wild. If only the reality of 2009 and what’s to come weren’t wild enough. CRE values will likely get crushed during the next 12-24 months. We hope that you tenants are paying attention.

By the way:

This is only a joke, played primarily on a couple of our competitors who really and truly tried to give securities advice to tenants—when they published an article advising tenants to buy EOP stock as a hedge against getting creamed in leasing negotiations with EOP during a tight market. Sam Zell took the tenant’s money—twice—and the brokers made off.

Economic Quicksand

We’re up to our knees here, in California, pushing beyond 12% unemployment…the highest level since WWII…while the nation’s joblessness is the worst since the Great Depression. Yet, all credit given to the Wall Street Lobby, our stock markets have soared this year. Who really understands these markets? Oh, people do. You may not be one of them (consider yourself fortunate). Former Merrill Lynch economist, David Rosenberg said of the rebound, “What happened was that the economy received a heavy dose of medication from Uncle Sam. The reality is that no one has a clue as to what the economy really looks like because it’s been so dramatically sedated by the federal government. It’s as though we’ve received a massive tranquilizer, but eventually, tranquilizers wear off.” That said, he thinks the “bear-market rally” is over and we have another 8-9 years before sunshine appears.

John Embry, of enviable track record at Sprott Private Wealth Advisory, issued this prognosis recently (recall that we sent you Sprott’s article, “Requiem for a Housing Bubble” back in 3Q 2006!):

There are numerous red flags but, suffice to say, an estimated $5 TRILLION funding requirement for the world’s governments in the next 12 months is very symptomatic of the problem. There are not remotely enough available savings globally to deal with this issue, so quantitative easing or, less politely stated, unlimited money printing is here to stay.

In the face of this, a recent comment by Fed Chairman Ben Bernanke during Congressional testimony seems to have been conjured up in fantasyland.

“We believe that it is important to assure the public and the market that the extraordinary policy measures we have taken in response to the financial crisis and the recession can be withdrawn in a smooth and timely manner as needed,” he stated, “thereby avoiding the risk that the policy stimulus could led to a future rise in inflation.”

What a joke! Any serious attempt to withdraw a significant amount of stimulus by either raising interest rates or shrinking the Fed’s balance sheet would almost certainly crater the economy in its current fragile state.

The depth of the U.S. financial malaise may have been best captured by Neil Barofsky, the inspector general of TARP (the Troubled Asset Relief Program) when he estimated that the bailouts, bank rescues and other economic lifelines could end up costing the U.S. federal government as much as $23.7 TRILLION. If that number seems daunting, it should because it represents 175 per cent of the current-year GDP in the U.S.

This makes Bernanke’s observation some 18 months ago when he stated that the subprime crisis was contained seem particularly ludicrous today and calls into question his judgment. In any case, given his nickname of Helicopter Ben, which derives from his unfortunate comment years ago about dropping money from helicopters to forestall deflation, any suggestion from him about withdrawing stimulus in the current circumstances should be taken with a large grain of salt.’

And with that, Mr. Embry sees gold heading to $1,500/oz….

Bill Gross, Managing Director of PIMCO, shared his recent wisdom, thus:

There are signs that California voters are ready to make some tough choices, having recently refused to pass five propositions that would have extended tax hikes and failed to address spending. Whether or not Governor Schwarzenegger and legislators will agree to a constitutional convention to address the poisonous proposition plebiscite itself is a larger question that will likely be affirmatively answered only if the state economy continues to remain in the tank, which it likely will. But California’s problems, while somewhat unique and self-inflicted, are really America’s problems, and not just because the California economy is 15% of national GDP. While California’s $26 billion deficit is not directly comparable to the federal gap of $1 trillion-plus, they both reflect a lack of discipline and indeed vision to perceive that the strong growth in revenues was driven by the same excess leverage and the same delusionary asset appreciation that was bound to approach cliff’s edge. California’s property taxes, income taxes, and sales taxes were all artificially elevated by national and indeed global imbalances as the U.S. manufactured paper, and Asia manufactured things in mercantilistic exchange. Total tax revenues have actually fallen 14% over the past 12 months in California and substantially more in other states. At some point, that Fantasyland merry-go-round had to stop and whether the defining moment was marked by Bear Stearns, Lehman Brothers, or the tumultuous week that followed in September of 2008 is really not the point.

What is critical to recognize is that both California and the U.S., as well as numerous global lookalikes such as the U.K., Spain, and Eastern European invalids, are in a poor position to compete in a global economy where capitalism is morphing from its decades-long emphasis on finance and leveraged risk taking to a more conservative, regulated, production-oriented system advantaged by countries focusing on thrift and deferred gratification. The term “capitalism” itself speaks to “capital” – the accumulation of it and the eventual efficient employment of it – for growth in profits and real wages alike.

What California once had and is losing rapidly is its “capital”: unquestionably in its ongoing double-digit billion dollar deficits, but also in its crown jewel educational system that led to Silicon Valley miracles such as Hewlett Packard, Apple, Google, and countless other new age innovators. In addition, its human capital is beginning to exit as more people move out of the state than in. While the United States as a whole has yet to suffer that emigration indignity, the same cannot be said for foreign-born and U.S.-educated scientists and engineers who now choose to return to their homelands to seek opportunity. Lady Liberty’s extended hand offering sanctuary to other nations’ “tired, poor and huddled masses” may be limited to just that. The invigorated wind up elsewhere.

Now that our financial system has been stabilized, one wonders whether California’s “Governator” and indeed the Obama Administration has the capital, the vision, and indeed the discipline of its citizenry to turn things around. Our future doggie bags can hold steak bones or doo-doo of an increasingly familiar smell. For now investors should be holding their noses, their risk orientation, as well as their blue bags, until proven otherwise. Specifically that continues to dictate a focus on high quality bonds and steady dividend paying stocks that can survive, if not thrive, in our journey to a “new normal” economy of slower growth, muted profit gains, and potential capital destruction via default, abrogation of property rights, and dollar devaluation.

Oxymoron: Jobless Recovery

Our economy, or at least what we knew of it before the Great Recession, was 70% driven by consumer spending. The current soothsayers pronouncing “recovery” make little sense without the return of the almighty American shopper—who’s nowhere to be found. Retail isn’t just dead; it’s double-dead. But wax on they will on Wall Street. Some “consumer confidence” reports indicate the first uptick since 2007; that’s a slow news day. The fact that the pace of the downward spiral has slowed is intended to lift our day. But when “recovery” hits, it will be WITH jobs. And with savings. And with much-reduced credit and leverage at the consumer level. Or it just won’t happen.

Wall Street cannot produce a turn-around without Main Street. Not to be completely cynical, but Main Street couldn’t have climbed further and faster into Wall Street’s pocket over the past few decades. The smell of money? Irresistible. Even in today’s commercial real estate markets we see evidence of all-too-quick-forgiveness. Hines, who just handed the keys back to their lenders on 333 Bush Street in San Francisco; the Watergate Towers in Emeryville; and their San Rafael project—all forgiven, perhaps, while they announce a new $3.5 BILLION global REIT offering. They expect to generate attractive returns over the next 8-10 years. In the meantime, Hines will undoubtedly extract huge fees.

Hines’ announcement came on almost the same day as Maguire Properties’ announcement of its return of its 1.7 million square foot Park Place and six other properties to their lenders. Which other properties? Several they acquired from EOP/Blackstone. Bizarre, isn’t it, that some of us actually predicted the decline in commercial real estate values around the time that Sam Zell sold EOP in 2006. It was 4Q 2006, when I wrote “The Sale(s) Of The Century: Goodbye Equity Office”.

Vacancy Rates: Are Your Options GROWING?

Tenants should watch carefully to detect how and to what extent your field of options changes. Which size blocks of space are getting leased? Discussing vacancy and absorption rates can be confusing to some. What language makes sense to tenants? Tenants ask, “Tell me about my specific options. How many choices do I have?” Are your options growing, as a result of leasing inactivity? Review the chart, below, and let’s discuss.

Here’s an intriguing statistic for you. BET YOU’LL BE BAFFLED: In Q2 of 2001, Bay Area Counties had a supply of 42 million square feet available for lease on the market. Today the Bay Area markets have 61 million square feet on the market. Tenants in San Francisco have a MUCH LARGER number of parcels to choose from in today’s market than in Q2 of 2001—the period just before our markets crashed. Today the trend for absorption has turned “down”…and the stats should give you reason to wonder—what kind of Kool-Aid has the landlord community been drinking? [In Q2, 2001, there were only 202 parcels of spaces available in San Francisco in the 5-10,000 sf range; 173 parcels in the 10-20,000 sf range; and only 67 parcels in the 20-40,000 sf range.]

Please note: We provide Bay Area market data and analyses for the current year only. To request commercial real estate market data for previous quarters, please contact us.

You can request a free space survey, containing all direct and sublease space meeting your specific requirements. We can also provide building photographs, floor plans, leasing histories and more. You’ll receive your survey within one business day. To discuss your space needs in person, call 415-434-2820 or email dan@TheSpacePlace.net.

Take Me Straight to the Numbers: San Francisco Bay Area Rental Rates. Supply / Demand.

Please note: We provide Bay Area market data and analyses for the current year only. To request commercial real estate market data for previous quarters, please contact us.

Who Has the Most Space in San Francisco? Surprise…

When we approach a prospective new tenant client, we tell them that we NEVER represent landlords, always avoiding this conflict of interest. So, which of our competitors—leasing firms—do the most landlord representation, and who controls the most space in San Francisco? And, most importantly, why would you feel comfortable having them represent YOU?

Below we’ve surveyed the entire 110 million square foot inventory of San Francisco, and illustrated the companies with the most control of space on the market, the Top 25. You know from our other stats that 19.98 million square feet is now on the market in San Francisco. Of the top 8 companies, ALL are office leasing brokerage firms, controlling 77% of the City’s vacancy! These brokerage firms are beholden to more than 370 local landlords. Since their allegiance is committed to so many landlords, how can they possibly represent YOUR interests—the tenant’s interests—objectively and aggressively? The top brokerage companies on the list control more of the City’s vacancy than Shorenstein (#10); Hines (#11); RREEF (#12); and more than Boston Properties (#14). Surprised, are you not? In the case of Studley, our friendly tenant-representation competitor, they represent over 200,000 square feet of space available in 11 different buildings. How can they objectively represent YOU, the tenant, if you choose to pursue any of their sublease space?!

| % Market Share | Square Feet | # of Landlords/ Buildings | ||

|---|---|---|---|---|

The % in the chart below refers to the percentage of vacant space under exclusive listing by each company. The accompanying figure is the actual square footage available for lease. We have also noted the number of landlords / buildings represented by each entity. * Denotes listing brokers. All other companies listed are landlords/developers. |

||||

| 1 | *The CAC Group | 13.6 | 3,279,002 | 58 |

| 2 | *Jones Lang LaSalle | 12.2 | 2,937,539 | 28 |

| 3 | *Cornish & Carey Commercial—ONCOR | 7.2 | 1,731,259 | 24 |

| 4 | *Cushman & Wakefield of California | 7.2 | 1,726,854 | 65 |

| 5 | *Colliers International | 7.0 | 1,693,336 | 76 |

| 6 | *CB Richard Ellis | 6.9 | 1,674,850 | 28 |

| 7 | *Grubb & Ellis | 5.5 | 1,336,811 | 54 |

| 8 | *GVA Kidder Mathews | 4.7 | 1,134,385 | 37 |

| 9 | Shorenstein Company, LLC | 1.7 | 418,728 | 7 |

| 10 | Hines | 1.7 | 408,951 | 9 |

| 11 | RREEF America LLC | 1.7 | 400,000 | 1 |

| 12 | Newmark Knight Frank | 1.5 | 373,991 | 14 |

| 13 | Boston Properties Limited Partnership | 1.3 | 315,082 | 4 |

| 14 | Beacon Capital Partners, Inc. | 1.3 | 307,000 | 1 |

| 15 | Tishman Speyer | 1.2 | 300,529 | 3 |

| 16 | SKS Investments | 1.0 | 250,000 | 2 |

| 17 | Retail West | 1.0 | 242,000 | 1 |

| 18 | The Presidio Trust | 1.0 | 236,029 | 46 |

| 19 | McCarthy Cook & Co. | 0.9 | 226,826 | 3 |

| 20 | Studley | 0.9 | 218,996 | 11 |

| 21 | *TRI Commercial / CORFAC International | 0.9 | 214,604 | 50 |

| 22 | *NAI BT Commercial | 0.7 | 160,912 | 27 |

| 23 | *Colton Commercial & Partners | 0.6 | 155,765 | 21 |

| 24 | JRT Realty Group, Inc. | 0.6 | 143,086 | 1 |

| 25 | HC&M Commercial Properties, Inc. | 0.6 | 140,794 | 27 |

| Total | 22,534,000 | |||